december child tax credit 1800

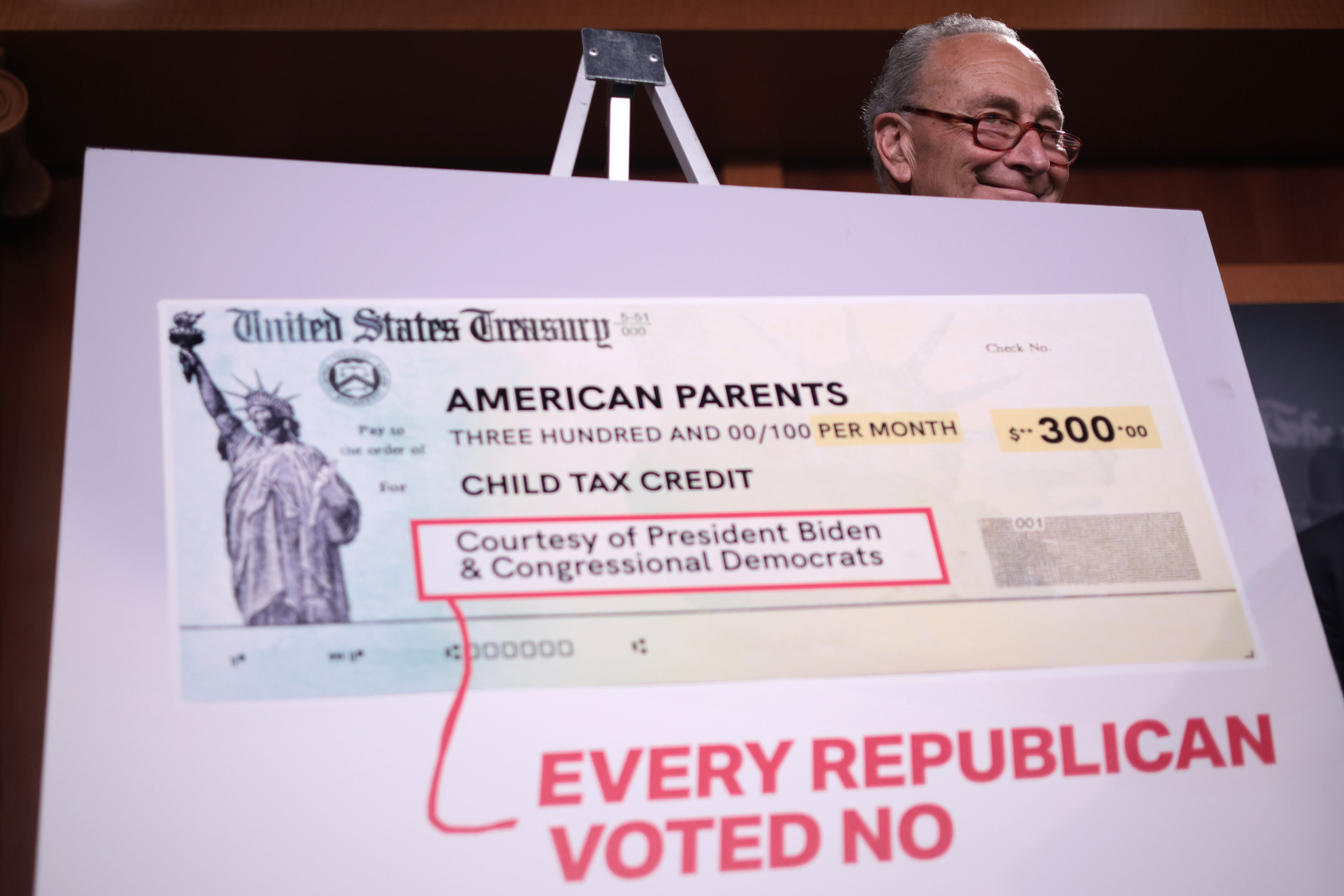

The american rescue plan which was signed in march of 2021 by president joe biden increased the existing child tax credit from 2k per child to 3k per child over the age of six and from 2k per child to 36k per child for children under the age of six. Joe Biden s child tax credit plan will see those who meet the final November 15 deadline potentially receive up to 1800 per child come December.

Child Tax Credit Website Aims To Help Parents Get 1 500 Or More 9news Com

7 rows The 2021 advance monthly child tax credit payments started automatically in July.

. Ad Get Your Maximum Refund Guaranteed Even If Youve Received The. The amount you are paid in a lump sum this year depends on what you qualified for and received between July and December last year. Deadlines for opting in and out of the child tax credit payments are approaching fast.

Hamilton a researcher at Appalachian State. Those who signed up will receive half of their total child tax credit payment up to 1800 as a lump sum in December. Its possible to get 1800 for the December child tax credit payment heres how.

Child tax credit payments went out automatically starting in July to families who had their tax return details on. The New York Times Reported On Dec. Or youll get one in just December of that full half-year amount Thats potentially 1800 for each child up to age 5 or 1500 for kids age 6.

The remaining 1800 will be. Eligible families will receive up to 1800 in cash through December however the tax credit has a wrinkle that may prompt some families to bypass the federal program. Since payments have been going out since July that would mean.

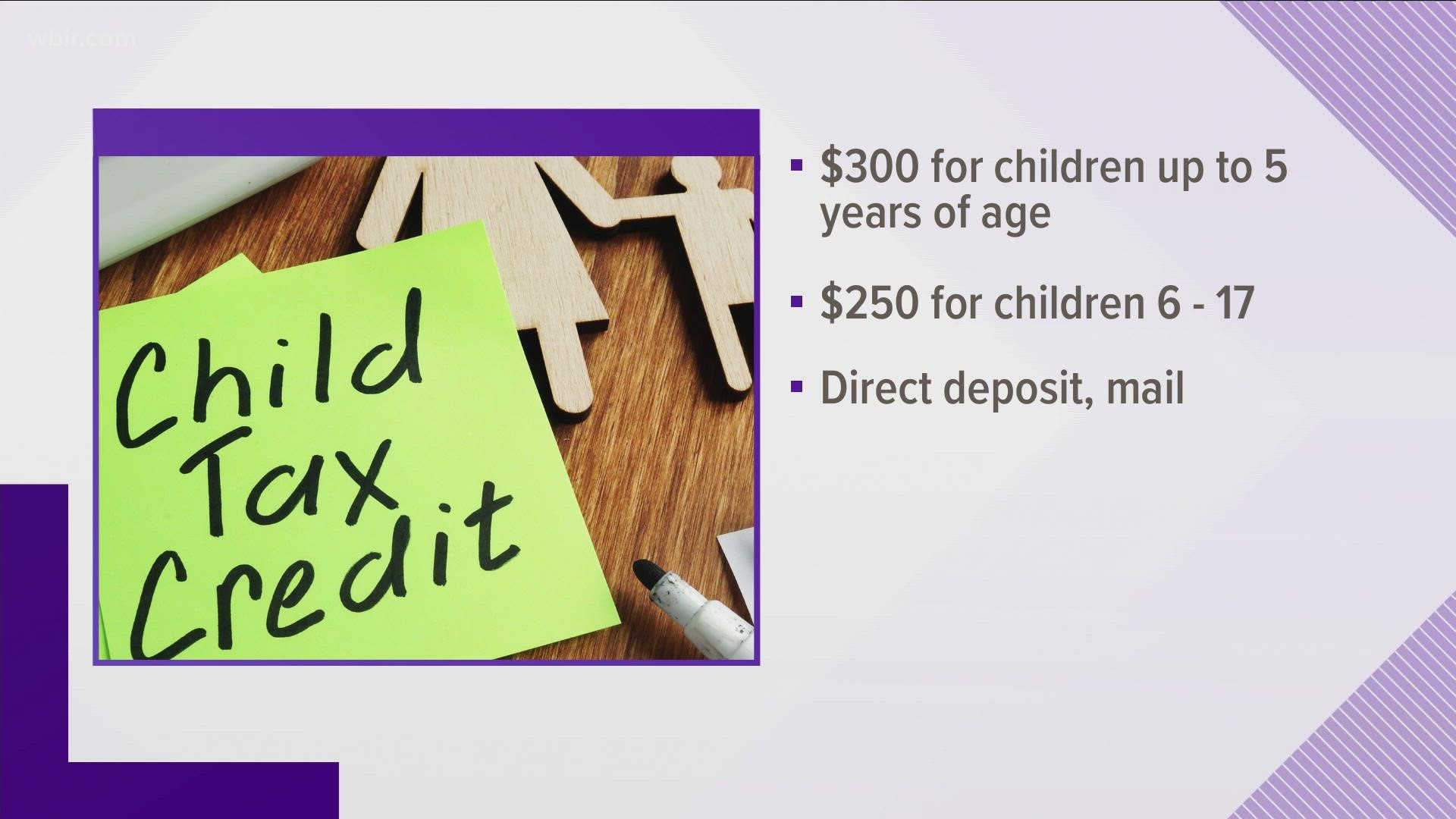

This means a payment of up to 1800 for each child under 6 and up to 1500 for each child ages 6 to 17. What that means is that tens of thousands of households will receive a December payment of up to 1800 per child for dependents under the age of 6 or up to 1500 per child for those ages 6 to 17. This means a family can get a payment of up to 1800 for.

Child Tax Credit 2022 December. Families who sign up will normally receive half of their total Child Tax Credit on December 15 according to the IRS. The deadline to file a simplified return and sign up for CTC payments is November 15.

Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. The final monthly child tax credit payment is due to go out on Wednesday. When to expect December child tax credit.

For the child tax credit payments. To opt out you need to do so by tomorrow Thursday Nov. It means those not receiving the payments for the first five months but who chose and qualified for the December payment may get the full first half of the credit from December 15.

Those numbers are compared to a regular year. How Much Money Could You Get. If you opted out of partial payments before the first check went out youll get your full eligible amount with your tax refund -- up to 3600 per.

Non-filers who did not file taxes in 2019 or 2020 due to a low enough income can still claim the payments. The portal intended to make it easier for families to receive monthly child tax credit payments as well as any stimulus checks they may be eligible to receive. The portal intended to make it easier for families to receive monthly child tax credit payments as well as any stimulus checks they may be eligible to receive.

This letter will help taxpayers reconcile their 2021 child tax advance payments with. Typically families get up 300 per child - but some will get more this month. Staff Report November 10 2021 214 PM.

There is one group of people who are eligible to receive the entire lump sum payment of up to 1800 in Dec. While there is no limit for the number of children eligible for the expanded credit there is. Those families who used the tool to file by last weeks November 15 deadline will then receive all of the 2021 payments on December 15 totaling up to 1800 per child.

The IRS sent Letter 6419 the child tax advance payment letter in December 2021 to January 2022. Typically qualifying families receive up to 300 per child per month. The Advance Child Tax Credit Received From July Through December Last Year Amounted To Up To 1500 Or Up To 1800 For Each Child Depending On The Childs Age.

Parents can receive up to 1800 for every child under the age of five and 1500 each for children between 6 and 17. If you have been receiving the Child Tax Credit monthly payments since July you could be given up to 1800 for each child aged five and younger or up to 1500 for each child aged between six. Military families and individuals can qualify for up to 1800 in federal child tax credits even if they didnt file taxes in 2019 or 2020 according to the.

According to the IRS families who sign up before the deadline can get all the money they are owed this year in one payment on December 15. Well that was one of the more compelling statistics for me Leah Hamilton said Tuesday night in Morgantown. 20During its run from July to December last year the Child Tax Credit allotment was bread-and-butter for countless American households and maybe literally so in places such as West Virginia.

Or youll get one in just December of that full. If youre eligible for the child tax credit and sign up in time youll receive a single payment from the IRS in. To qualify for the full payments couples need to make less than 150000 and single parents who file as heads of households need to make under 112500.

The enhanced Child Tax.

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Irs Child Tax Credit Payments Start July 15

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check

You Might Be Able To Get A 1 800 Stimulus Check Before Christmas

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Child Tax Credit Will Monthly Payments Continue In 2022 King5 Com

The December Child Tax Credit Payment May Be The Last

December Child Tax Credit What To Do If It Doesn T Show Up Wkyc Com

Child Tax Credit Schedule 8812 H R Block

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet

Child Tax Credit Payments Of 1 500 Or 1 800 Will Be Sent To Families Early Next Year

The Next Child Tax Credit Payment Is Sept 15 Here S What You Need To Know The Washington Post

Child Tax Credit 2022 Monthly Payment Still Uncertain King5 Com

4 Tips To Help You Navigate The New Tax Landscape Military Com

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out Cbs News

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Advance Child Tax Credit Payments Learn If You Need To Pay Money Back Cnet

Child Tax Credit December Payment Will See Some Families Get 1 800 Per Kid In Just 4 Days Are You Eligible